Investing in silver has long been a favored approach for those seeking to hold wealth, hedge in opposition to inflation, and diversify their portfolios. Among the many alternatives to be had to traders, two of the most famous selections are Silver American Eagles and junk silver. While each are U.S. Minted silver merchandise, they provide unique advantages and disadvantages, making the choice between them dependent on an investor’s precise needs, goals, and marketplace conditions.

Silver American Eagles, produced through america Mint, are quite appeared for their government backing, prison smooth reputation, and high-quality layout. Silver Eagles for sale entice both traders and creditors because of their purity, liquidity, and ancient significance. Junk silver, however, refers to pre-1965 U.S. Coinage that carries 90% silver but holds no numismatic or collector value beyond its silver content. Both forms of silver have their area in an investor’s portfolio, however figuring out which one offers higher fee requires a deeper understanding of their distinct traits.

Understanding Silver American Eagles

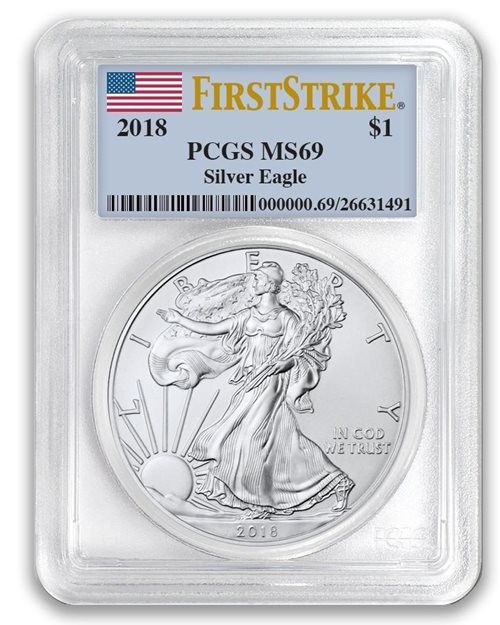

Silver American Eagles had been first introduced in 1986 as a part of the U.S. Mint’s American Eagle bullion program. Each coin contains one troy ounce of .999 exceptional silver and includes a face cost of $1. However, its actual really worth is based totally instantaneous fee of silver and the coin’s top class, which includes minting costs, distribution expenses, and marketplace demand.

One of the number one benefits of Silver American Eagles is their reputation and liquidity. These coins are broadly normal in the valuable metals marketplace, making them easy to shop for and sell. Additionally, they are sponsored by way of the U.S. Authorities for his or her silver content and weight, supplying an added layer of protection for buyers.

Another massive component of Silver American Eagles is their aesthetic attraction and collectibility. Designed by way of Adolph A. Weinman, the obverse functions the classic Walking Liberty, whilst the opposite showcases a depiction of an eagle. Some buyers recognize these coins for his or her inventive cost and regularly purchase graded versions for numismatic purposes.

Despite their many blessings, Silver American Eagles commonly carry a better premium in comparison to different silver investments. The expenses related to minting and authorities backing contribute to this top class, which means buyers may pay above the spot rate when purchasing and might not absolutely recover this top class upon selling, in particular in volatile markets.

What Is Junk Silver?

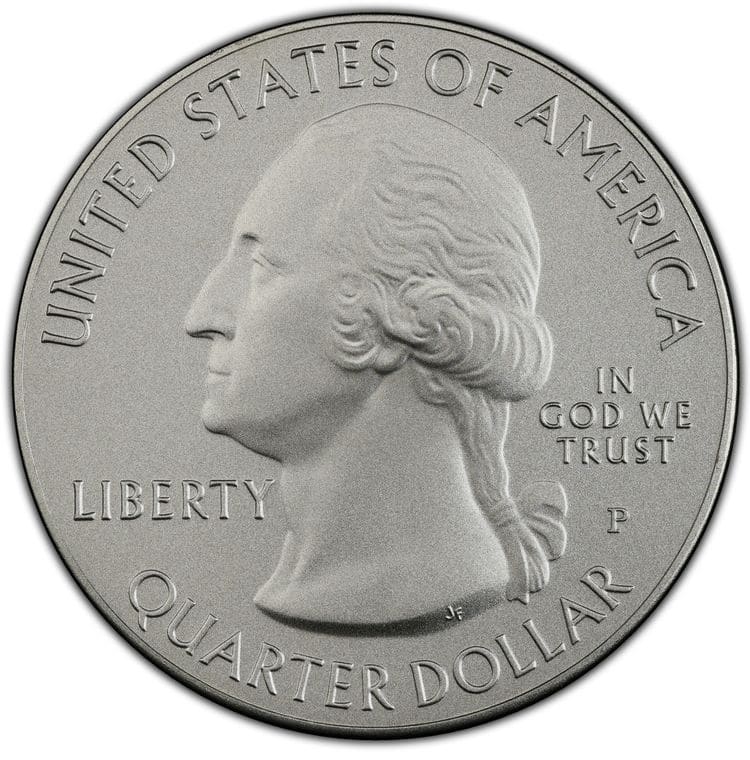

Junk silver refers to circulated U.S. Cash minted before 1965 that incorporate ninety% silver. This category consists of dimes, quarters, and half bucks, inclusive of the Mercury dime, Washington sector, and Franklin 1/2 greenback. Unlike Silver American Eagles, junk silver cash aren't produced as bullion however were once a part of regular foreign money movement.

The term “junk” does now not suggest that those cash lack price; instead, it indicates that they've no collectible numismatic fee past their silver content. Investors buy junk silver often for its soften cost, meaning the price is intently tied to the current silver spot charge without huge delivered rates.

One of the largest blessings of junk silver is its affordability. Because these cash do no longer convey the same high charges as Silver American Eagles, they may be obtained toward the silver spot rate, making them an attractive alternative for price range-conscious buyers. Junk silver is likewise notably divisible, as it is available in smaller denominations, making it easy to trade or use for barter functions in case of economic instability.

On the disadvantage, junk silver may also require extra attempt with regards to valuation. Since those coins are bought through weight in place of person unit fee, investors should be acquainted with their silver content to appropriately determine their worth. Additionally, the condition of junk silver varies broadly, and even as wear does now not considerably effect silver content material, it may have an effect on liquidity in positive markets.

Liquidity and Market Demand

Liquidity is a vital component while investing in silver, as traders need to make certain that they can without difficulty buy and sell their holdings whilst needed. Silver American Eagles have a clean benefit in this regard, as they may be universally identified, clean to authenticate, and distinctly well-liked through both traders and collectors. Many treasured metals dealers, on line platforms, and monetary establishments conveniently receive Silver American Eagles for purchase or sale.

Junk silver, while also liquid, may also require a chunk extra effort whilst promoting. Buyers regularly search for unique weights or quantities, and people unexpected with junk silver may additionally hesitate due to the dearth of a fixed unit rate. However, at some point of instances of financial uncertainty or silver shortages, junk silver can emerge as quite suitable because of its decrease rates and realistic usability.

Which Offers Better Value?

Determining which funding offers better value relies upon on several elements, inclusive of market conditions, investor desires, and rates.

For investors centered on long-time period balance and simplicity of liquidity, Silver American Eagles may be the better desire. Their widespread recognition, authorities backing, and ease of resale lead them to a solid alternative for folks who want a honest funding in silver.

On the alternative hand, for traders looking to maximize the amount of silver they collect for a given price range, junk silver frequently gives the better fee. The lower charges imply that consumers can obtain extra bodily silver for their cash, which can be beneficial if silver prices appreciate over the years.

Additionally, junk silver offers extra flexibility for smaller transactions or barter eventualities. In evaluation, Silver American Eagles, due to their better in keeping with-unit cost, may be much less sensible for fractional silver transactions.

Conclusion

Both Silver American Eagles and junk silver offer unique benefits and can serve one of a kind purposes in a diverse precious metals portfolio. Purchase silver coins for a combination of bullion funding and numismatic enchantment, making them an splendid choice for traders who fee liquidity, popularity, and long-time period appreciation ability. However, they come at a higher top class.

Junk silver, whilst much less aesthetically appealing and lacking authorities-backed weight guarantees, stays a value-effective way to acquire bodily silver. Its lower top class and divisibility make it an attractive alternative for those prioritizing affordability and versatility.

Ultimately, the great preference depends on an investor’s unique wishes. Some may also decide on a mixture of both to balance liquidity, top rate charges, and usability. Regardless of desire, both Silver American Eagles and junk silver remain precious belongings in the world of silver making an investment.